Understanding the 2025 Health Savings Account Contribution Limits

December 2, 2024 - 23:05

The new 2025 HSA contribution limits have been announced, providing important information for individuals looking to save money on taxes and manage healthcare costs effectively. Health Savings Accounts (HSAs) are a popular tool for individuals with high-deductible health plans, allowing them to set aside pre-tax dollars for medical expenses.

For the year 2025, the contribution limit for individuals is set to increase, providing an opportunity for greater tax savings. Families will also see an increase in their contribution limits, enabling them to save more for healthcare expenses. These adjustments are designed to keep pace with inflation and the rising costs of healthcare.

Individuals considering opening or contributing to an HSA should be aware of these new limits, as they can significantly impact their financial planning. Utilizing an HSA not only helps in covering out-of-pocket medical expenses but also offers tax advantages that can enhance overall savings. As healthcare costs continue to rise, understanding these changes is crucial for effective financial management.

MORE NEWS

February 24, 2026 - 18:27

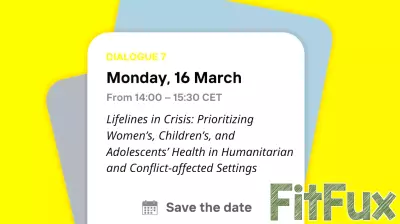

READY, SET, IMPLEMENT! Lifelines in Crisis: Prioritizing Women’s, Children’s, and Adolescents’ Health in Humanitarian and Conflict-affected SettingsIn a world increasingly defined by conflict, climate disasters, and displacement, a state of permanent crisis is threatening the health and rights of the most vulnerable. Over half of all maternal...

February 24, 2026 - 12:34

NO.olistudy,health.031526_2937 MJ.JPGA new, wireless sensor system is being introduced with the goal of enhancing safety and comfort for mothers during labor and delivery. The device, known as the Oli sensor, represents a significant...

February 23, 2026 - 14:37

Democrats decry meager medical care for detainees in funding fightA stark human cost is emerging within the nation`s immigration detention system, as advocates and lawmakers highlight dangerously inadequate medical care for detainees, trapped in a broader...

February 22, 2026 - 20:59

Study identifies long-term health risks in testicular cancer survivors treated with contemporary chemotherapyA landmark study has revealed that men who received modern chemotherapy regimens for testicular cancer face significantly elevated risks for a range of serious long-term health conditions, even...